Redd Law, PLC is excited to offer bankruptcy clients the opportunity to submit information to our firm using Lexria. In order to file bankruptcy, clients must provide significant financial information which includes bank account statements, pay stubs, home values and more. Now our clients can easily save time and obtain the required information by visiting our Lexria link. Get started with your free bankruptcy evaluation by CLICKING HERE.

Change to Michigan Wage Garnishment Law

Wage garnishments in Michigan used to have a 182 day expiration date regardless of whether the judgment was paid in full. Creditors had to submit a new request to the court and pay a new fee in order to have a new periodic garnishment issued. Effective September 30, 2015, MCR 3.101 provides that wage and other periodic garnishments will remain in effect until the judgment is paid in full. Individuals facing wage garnishment will still have options for stopping the garnishment such as bankruptcy and installment plans.

If you are facing a wage garnishment, contact Redd Law, PLC at (248) 455-6383 for a free initial consultation to discuss options for stopping the garnishment.

Rebuilding Credit after Filing Bankruptcy

It’s normal to be concerned about the credit score after filing bankruptcy. Rebuilding credit is important because a credit score can affect many things, such as interest on loans, insurance premiums and employment opportunities. Many potential clients ask if they have to wait seven years in order to mortgage a home or purchase a car. Fortunately, there’s no need to wait that long to begin rebuilding credit. In fact, it’s best to begin the rebuilding process as soon as the bankruptcy discharge is entered.

Take the following steps to improve your credit score after completing bankruptcy:

- Review your Credit Reports: After receiving the bankruptcy discharge, obtain a copy of your credit reports from all of the major credit reporting agencies. You are entitled to one free report every twelve months from each agency. If you haven’t received your free reports, you can visit the Annualcreditreport.com web site to get them. Once you receive the reports, review them for errors. Debt that has been discharged in bankruptcy should show a zero balance. If there are errors on the credit report, you can send a dispute letter to the credit reporting agency to have the information corrected.

- Obtain Credit: In order to rebuild credit, it is necessary to have credit. If you reaffirm a car loan during your bankruptcy case and you continue to make all payments before the due date, your credit score will gradually improve. Another option is to obtain a credit card. When searching for a credit card, it’s important to avoid applying for a lot of accounts at once because that can hurt your credit score. Some banks have tools that allow you to view cards that you are qualified for before applying. For example, the Capital One card finder tool allows you to search for cards for rebuilding your credit without affecting your credit score. You can also look for a secured credit card that requires a deposit in order to use the account since they’re easier to get. Remember to make sure that any debt you obtain is reported on your credit report since creditors are not required to report accounts and smaller companies might decide to forego the cost of doing so.

- Make Debt Payments on Time: Once you obtain credit, use it responsibly and make sure that all of your payments are made before the due date. Try to pay the full balance every month and be patient. A huge jump in credit score will not happen overnight, but within a couple of years, your credit score should be significantly higher.

Posted in Credit scores, Personal Finance, Rebuilding Credit

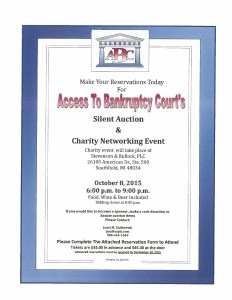

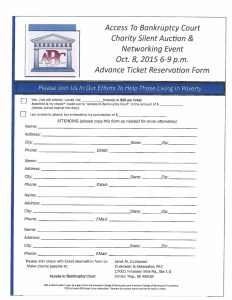

Upcoming Silent Auction and Networking Event

There is a silent auction and charity networking event being held October 8, 2015 from 6-9 pm at the offices of Stevenson & Bullock, PLC, 26100 American Drive, Ste 500, Southfield, MI 48034. The charity event will support the Access to Bankruptcy Court program which provides free bankruptcy assistance to low income debtors who are unable to afford an attorney. Redd Law, PLC represents debtors through the program. The entire bankruptcy community benefits when debtors are represented by an attorney instead of filing bankruptcy by themselves.

What Happens During a 341 Hearing?

After filing a bankruptcy case, the court sends out a notice containing the date and time for a 341 Hearing. The 341 hearing is also referred to as a Meeting of Creditors. A small group of people is scheduled for the same day and time.

After the debtor’s case is called, the debtor is sworn to tell the truth and the bankruptcy trustee reviews the debtor’s social security card and driver’s license.

Most of the trustees in the Eastern District of Michigan start with some verification questions. They want to verify that that all of the debtor’s creditors and assets were listed in the bankruptcy schedules. Then the trustee may ask specific questions about the bankruptcy petition and schedules that were filed with the court. In most cases, creditors do not attend the meeting. However, if a creditor does attend, the creditor will also have the opportunity to ask questions. Most debtors are surprised by how little time they spend at their meeting.

Discharging Student Loans

In most cases, student loans cannot be discharged in bankruptcy. However, you may be able to discharge your student loan if you qualify because the repayment of the student loan results in an “undue hardship” to you. In reviewing your request for a discharge of your student loans, the bankruptcy court will consider the following:

- Are you unable to maintain a minimum standard of living if you have to repay the student loans?

- Will your financial hardship remain the same for the amount of time it will take to pay off the loan?

- Have you made a good faith effort to repay the student loan?

Michigan Homeowner Assistance

Michigan homeowners who are defaulting on their mortgage or property taxes can receive financial assistance through the “A Step Forward” program. Homeowners who have had a financial hardship can apply for the program to pay mortgage arrears, partial mortgage payments or delinquent property taxes. Homeowners can also apply for a mortgage loan modification through the program.

Homeowners can apply even they’re in a Chapter 13 bankruptcy. Homeowners in a Chapter 7 bankruptcy must wait until after discharge to apply. For more information and to apply, homeowners can visit the following web site: A Step Forward

Mortgage Reaffirmation in Chapter 7 Bankruptcy

In a chapter 7 bankruptcy discharge, the underlying mortgage debt is discharged, but the lien remains. This means that a creditor cannot force a debtor to repay the debt, but if the debt is not paid, the creditor can still foreclose on the property. However, if a debtor signs a reaffirmation agreement with the creditor, then the creditor can still take action to collect the amount owed.

Generally, it is not a good idea to sign a reaffirmation agreement during a chapter 7 bankruptcy case. After a chapter 7 discharge, Debtors are allowed to keep their home as long as they continue making their mortgage payments. In the future, they may just walk away from their home if they decide that the payments are no longer affordable or if they just have no desire to keep the home. However, if a debtor signs a reaffirmation agreement, the creditor can sue the debtor or take other action to collect the remaining balance. Without the reaffirmation agreement, the creditor can only take the property in a foreclosure action.

Some debtors are concerned about how their payments are reported on a creditor report if no reaffirmation agreement is signed. That’s because some mortgage companies stop reporting payments if no reaffirmation agreement is signed by the debtor. However, debtors always have the option to submit payment information to the credit reporting agencies themselves.

Determining Property Values in Bankruptcy

Everyone who files bankruptcy must disclose all of their real and personal property. The value of real estate can be easily done with an appraisal or market analysis. For cars, debtors can look at the blue book value. The biggest problems with valuation arises when debtors attempt to determine a value for other personal property such as clothing, household goods and furnishings.

When determining value, it’s important to think carefully about what you actually own. You must consider the age and condition of the property. Although jewelry, antiques and collectibles often increase in value, most property items decrease in value. Therefore, old clothes, furniture and appliances will usually be worth less than the original purchase price.

Generally, property is worth what someone else is willing to pay for it. If you’re completely unsure about what you should list as the value of certain property, it can be helpful to browse web sites that feature used items for sale such as eBay and Craigslist. Ultimately, the value that you list will be an educated guess because there is no way to know for sure how much someone is willing to pay for something unless you actually attempt to sell it.

Some of my clients have inquired about whether the bankruptcy trustee would show up at their homes to look at their personal belongings. I have not seen it happen, but it can happen if the trustee has a reason to believe that the debtor owns more than what is listed on the bankruptcy schedules.

Access to Bankruptcy Court

There have been problems with people who are unable to hire an attorney filing bankruptcy themselves. Unfortunately, their paperwork is often incorrectly completed and they often do not follow the required court procedures. Therefore, there is a new pro bono program designed to provide free legal assistance to low income debtors.